capital gains tax usa

Many people qualify for a 0 tax rate. The rates are much less onerous.

Relative Value Of 100 Map Usa Map Historical Maps

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

. Since 2003 qualified dividends have also been taxed at the lower rates. For most of the history of the income tax long-term capital gains have been taxed at lower rates than ordinary income figure 1. The capital gains tax rates in the tables above apply to most assets but there are some noteworthy exceptions.

Long-term capital gains tax rates typically apply if you owned the asset for more than a year. Short term gains on stock investments are taxed at your regular tax rate. First deduct the Capital Gains tax-free allowance from your taxable gain.

Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held. 8400000 and sold in August 2022 for Rs. The flat was purchased in January 2021 for Rs.

The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income. At a certain point it was inevitable the powers-that-be would decide it was worth getting messy to get to the. Heres how short-term capital gains tax rates for 2022 compare.

Long term gains are taxed at 15 for most tax brackets and zero for the lowest two. Short-Term Capital Gains Tax Rates 2022 and 2021. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset.

Short-term capital gains for those assets held less than one year or 12 months are taxed at ordinary income rates. That means the tax on any investments you sell on a short-term basis would be determined by your tax bracket. Capital gains are subject to CIT taxed at 25 there is no corporate capital gains tax in Uruguay.

Capital gains withholding - Impacts on foreign and Australian residents. Here is a simple capital gains calculator to help you see what effects the current rates will have in your own life. Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total.

House will be treated as capital gains and will be charged to tax under the head Capital Gains. Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

In the first survey 40 said they would vote in favor of I-1929 with 39 opposed and another 20 saying they were unsure. Weve got all the 2021 and 2022 capital gains tax rates in one. A capital gain or loss is the difference between what you paid for an asset and what you sold it for less any fees incurred during the purchaseSo if you sell a property for more than you paid for it thats a capital gain.

As of April 2022 federal capital gains tax rates in the US. Uzbekistan Republic of Last reviewed 26 January 2022. Kapoor is a property dealer.

The IRS uses ordinary income tax rates to tax capital gains. Beginning in 2013 long-term capital gains are taxed at varying. You dont need to include a capital gain if its from the sale of your main home you owned for at least 5 years and the profit is less than 250000.

CGT for specific investment products. Long-term capital gains on so-called collectible assets. For middle-income investors the national tax rate for capital gains was 15.

This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property. In certain situations you may be able to sell a home without paying capital gains tax on the profits. Capital gains are subject to IRPF or IRNR taxed at 12 with some exceptions.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. Market valuation for tax purposes. In the United States of America individuals and corporations pay US.

The housing market is like a garden hose flailing out of control. Long-term capital gains tax is a tax applied to assets held for more than a year. We will discuss such effective and legal methods as 1031 tax-deferred like-kind property exchange 1033 exchange of condemned property how to comply with the sections 721 and 453 tax benefits of opportunity zones when selling commercial real.

The maximum long-term capital gains and ordinary income tax rates were equal in 1988 through 1990. Foreign resident capital gains withholding. MAXIMUM TAX RATE ON CAPITAL GAINS.

The rates are much less. A capital gain is the amount you get from selling property like stock a house or a mutual fund. Court battle over capital gains tax could rewrite Washingtons tax code.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Your tax bracket is based on your income and filing status. Trust non-assessable payments CGT event E4.

Depending upon the applicable capital gains rate for your income bracket this could increase the value of. For example if you buy stock for 1000 and sell it for 1250 you have capital gain of 250. If you have owned your home and used it as your main residence for at least two of the five years prior to selling it then you can usually exclude up to 250000 of capital gains on this type of real estate if youre single and up to 500000.

Capital gains withholding - for real estate agents. What is capital gains tax. One major exception to the capital gains tax rate on real estate profits is your principal residence.

Capital gains withholding - a guide for conveyancers. However there may be exceptions to this rule. Capital gains tax CGT for those who are new to this is the levy you pay on the capital gain made from the sale of that asset.

With average state taxes and a 38 federal surtax the wealthiest people would pay. There is no individual capital gains tax in Uruguay. Ranged between 0 and 28.

He purchased a flat for resale. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

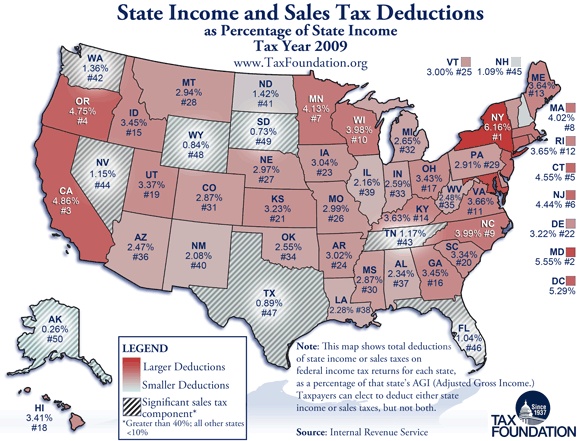

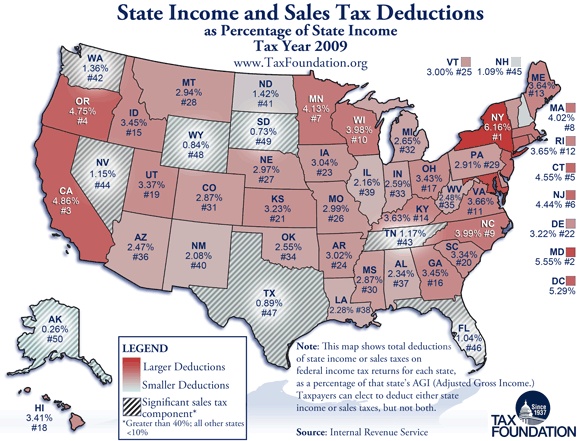

State And Local Tax Deductions Data Map American History Timeline Map Diagram

Here S The Formula For Paying No Federal Income Taxes On 100 000 A Year Marketwatch Federal Income Tax Income Tax Income

Paul Ryan Budget Business Insider Capital Gains Tax Budgeting Income Tax Brackets

Sales Taxes In The United States Wikipedia The Free Encyclopedia Capital Gains Tax Sales Tax Tax

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

Monday Map State Income And Sales Tax Deductions Data Map Map Map Diagram

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Different Types Of Taxes We Pay In The Us If You Want To Know What Types Of Taxes Americans Have To Pay Scro Types Of Taxes Payroll Taxes Capital Gains Tax

Pin By Brian On Mining Tax Deductions Financial Advice Tax Questions

Taxation In Australia Wikipedia Capital Gains Tax Income Tax Return Payroll Taxes

Capital Gains Tax Capital Gain Integrity

Federal Mineral Royalty Disbursements To States And The Effects Of Sequestration Infographic Map Map Teaching Geography

Imgur Com History Notes Infographic Map Imaginary Maps

How To Sell Property In India And Bring Money To Usa Steps With Pictures Things To Sell Sell Property Inheritance Money

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

5 3 Explanation Interpretation Of Article V Under U S Law Canada U S Tax Treaty Rental Income Interpretation Real Estate Rentals